Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Accept the project only if its ARR is equal to or greater than the required accounting rate of return. The accounting rate of return percentage needs to be compared to a target set by the organisation. If the accounting rate of return is greater than the target, then accept the project, if it is less then reject the project.

Accounting Rate of Return Formula

The required rate of return (RRR), or the hurdle rate, is the minimum return an investor would accept for an investment or project that compensates them for a given level of risk. It is calculated using the dividend discount model, which accounts for stock price changes, or the capital asset pricing model, what are accrued expenses and when are they recorded which compares returns to the market. The accounting rate of return is a capital budgeting metric to calculate an investment’s profitability. Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition.

Collect payments in Europe? Read our guide to SEPA Payments

This indicates that for every $1 invested in the equipment, the corporation can anticipate to earn a 20 cent yearly return relative to the initial expenditure. Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Some limitations include the Accounting Rate of Returns not taking into account dividends or other sources of finance.

What is Simple Interest in Interest Calculation?

It takes into account the profits generated throughout the investment’s existence, which provides a more comprehensive view of its profitability. This can be particularly helpful if you’re planning for the long term and want to assess the overall return on your investment. Like any other financial indicator, ARR has its advantages and disadvantages. Evaluating the pros and cons of ARR enables stakeholders to arrive at informed decisions about its acceptability in some investment circumstances and adjust their approach to analysis accordingly. It’s important to understand these differences for the value one is able to leverage out of ARR into financial analysis and decision-making.

What Is the Difference Between ARR and Internal Rate of Return (IRR)?

Investments are assessed based, in part, on past rates of return, which can be compared against assets of the same type to determine which investments are the most attractive. Many investors like to pick a required rate of return before making an investment choice. The ARR is the annual percentage return from an investment based on its initial outlay.

What is ARR?

There are a number of formulas and metrics that companies can use to try and predict the average rate of return of a project or an asset. Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The Accounting Rate of Return can be used to measure how well a project or investment does in terms of book profit. For example, say that an investor purchased a short-term bond, such as a US Treasury Bill, for $950 and redeemed it for its face value of $1000 at maturity. Calculating the rate of return gets the percentage change from the beginning of the period to the end. Remember that you may need to change these details depending on the specifics of your project.

If analysts rely solely on the Accounting Rate of Return, such a low result will make them neglect an otherwise profitable project. The investment appraisal approach is a way of appraising financial assets following their anticipated future cash flows. Accounting Rate of Return is a metric that estimates the expected rate of return on an asset or investment. Unlike the Internal Rate of Return (IRR) & Net Present Value (NPV), ARR does not consider the concept of time value of money and provides a simple yet meaningful estimate of profitability based on accounting data. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula.

- A firm understanding of ARR is critical for financial decision-makers as it demonstrates the potential return on investment and is instrumental in strategic planning.

- Accounting Rate of Return (ARR) is one of the best ways to calculate the potential profitability of an investment, making it an effective means of determining which capital asset or long-term project to invest in.

- Specialized staff would be required whose estimated wages would be $300,000 annually.

- However, in the general sense, what would constitute a “good” rate of return varies between investors, may differ according to individual circumstances, and may also differ according to investment goals.

- Imagine a company is considering a project with a $50,000 initial investment and expected to generate profits of $10,000 in year 1, $12,000 in year 2, and $8,000 in year 3.

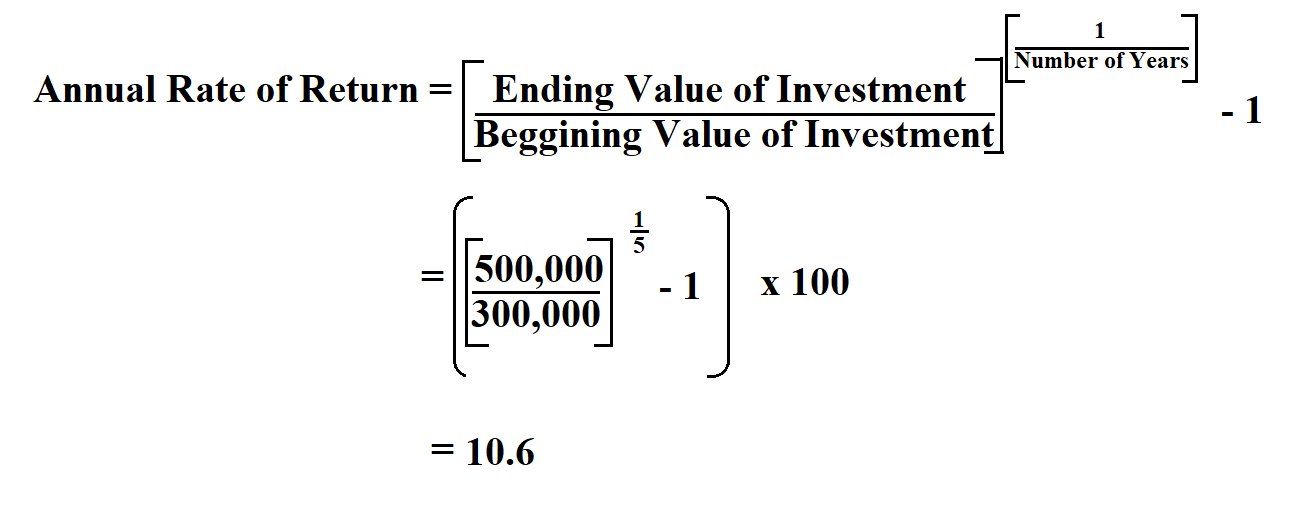

Based on the below information, you are required to calculate the accounting rate of return, assuming a 20% tax rate. The accounting rate of return is a simple calculation that does not require complex math and allows managers to compare ARR to the desired minimum required return. For example, if the minimum required return of a project is 12% and ARR is 9%, a manager will know not to proceed with the project. The rate of return can be calculated for any investment, dealing with any kind of asset. Let’s take the example of purchasing a home as a basic example for understanding how to calculate the RoR.

Other factors such as risk, time value of money, and cash flows should also be considered. Furthermore, the accounting rate of return does not account for changes in market conditions or inflation. Therefore, it is important to use this metric in conjunction with other financial analysis tools to make sound investment decisions. The next step in understanding RoR over time is to account for the time value of money (TVM), which the CAGR ignores.