Also, a high asset turnover ratio interpretation may not necessarily always mean efficiency. Management can attempt to make a company’s efficiency seem better on paper than it actually is by selling off assets. An asset turnover ratio is a ratio that compares the total amount of a company’s net sales in dollar amount to the total amount of assets that was used to generate the stated amount of net sales. This means that an asset turnover ratio interpretation tells us how efficiently the assets of a company are deployed to generate revenue.

- This is your total sales number, minus any returns, damaged goods, missing goods, etc.

- However, it’s important to consider asset turnover in conjunction with other financial metrics and qualitative factors to get a more complete picture of the company’s financial health.

- A low total asset turnover means that the company is less efficient in using its asset to generate revenue.

- Remember that net sales only accounts for the products that end up in your customers’ hands at the end of the year—in other words, what they actually paid for.

Low asset turnover ratio interpretation

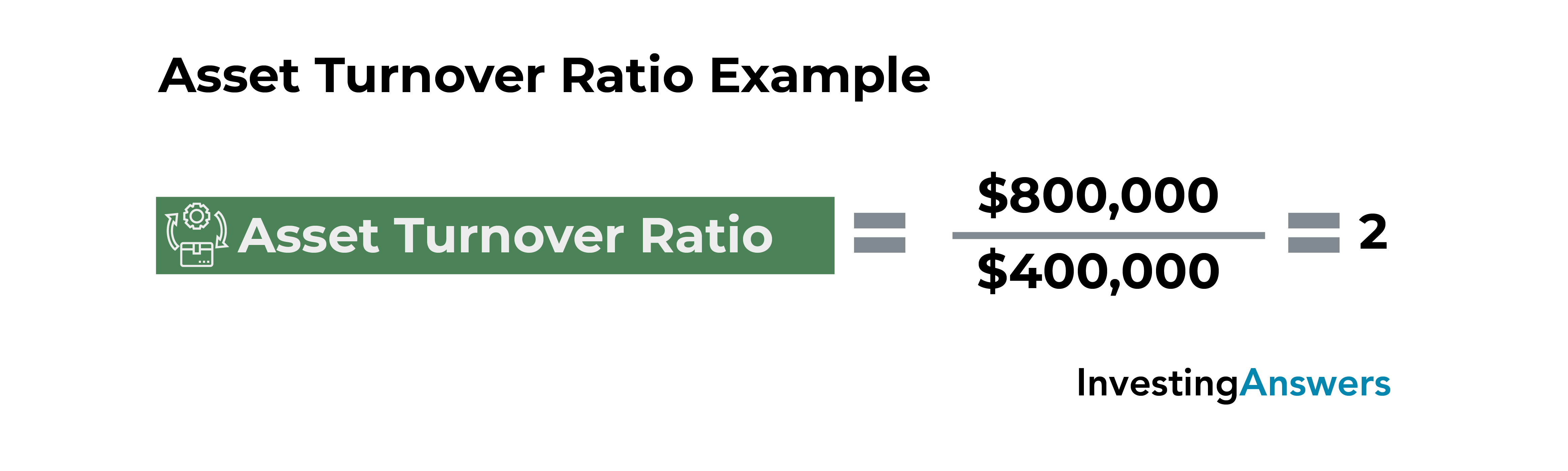

It compares the dollar amount of sales to its total assets as an annualized percentage. Thus, to calculate the asset turnover ratio, divide net sales or revenue by the average total assets. One variation on this metric considers only a company’s fixed assets (the FAT ratio) instead of total assets. The asset turnover ratio is an efficiency ratio that measures the ability of a company to generate revenue from its assets by comparing the company’s net sales with its average total assets. The asset turnover ratio interpretation can be used as an indicator of a company’s efficiency in using its assets to generate revenue. That is, the ratio interprets how efficiently a company can use its assets to generate revenue.

Interpreting results from the total asset turnover calculator

The FAT ratio, calculated annually, is constructed to reflect how efficiently a company uses these substantial assets to generate revenue for the firm. It should be noted that the asset turnover ratio formula does not look at how well a company is earning profits relative to assets. This is the distinct difference between return on assets (ROA) and the asset turnover ratio, as return on assets looks at net income, or profit, relative to assets.

Formula in ReadyRatios Analysis Software

The Asset Turnover Ratio is a financial metric that measures the efficiency at which a company utilizes its asset base to generate sales. The formula for the asset turnover ratio evaluates how well a company is utilizing its assets to produce revenue. The asset turnover ratio is most useful when compared across similar companies. Due to the varying nature of different industries, it is most valuable when compared across companies within the same sector. The asset turnover ratio is expressed as a rational number that may be a whole number or may include a decimal.

Total Asset Turnover Calculator

The turnover metric falls short, however, in being distorted by significant one-time capital expenditures (Capex) and asset sales. One critical consideration when evaluating the ratio is how capital-intensive the industry that the company operates in is (i.e., asset-heavy or asset-lite). On the flip side, a turnover ratio far exceeding the industry norm could be an indication that the company should be spending more and might be falling behind in terms of development.

This asset turnover ratio is also called the total asset turnover ratio and is mostly calculated on an annual basis. As a company’s total revenue is increasing, the asset turnover ratio can identify whether the company is becoming more or less efficient at using its assets effectively to generate profits. This interplay between asset turnover and profit margins underscores the importance of looking at financial ratios in conjunction. While asset turnover provides a lens into operational efficiency, ROA offers a broader view of overall profitability. Analysts often use both metrics in tandem to assess whether high sales volumes are indeed yielding adequate profits after accounting for the costs of the assets employed. Investments in fixed assets tend to represent the largest component of a company’s total assets.

The formula to calculate the total asset turnover ratio is net sales divided by average total assets. For instance, if the total turnover of a company is 1.0x, that would mean the company’s net sales are equivalent to the average total assets in the period. In other words, this company is generating $1.00 of sales for each dollar invested into all assets. Average total assets are found by taking the average of the beginning and ending assets of the period being analyzed.

She has specialized in financial advice for small business owners for almost a decade. Meredith is frequently sought out for her expertise in small business lending and financial management. Obotu has 2+years of professional experience in the business and finance sector. She enjoys writing in these fields to educate and share her wealth of knowledge and experience. What may be considered a “good” ratio in one industry may be viewed as poor in another. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

FAT only looks at net sales and fixed assets; company-wide expenses are not factored into the equation. In addition, there may be differences in the cash flow between when net sales are collected and when fixed assets are acquired. A higher turnover ratio indicates greater efficiency in managing fixed-asset investments.

Companies with cyclical sales may have low ratios in slow periods, so the ratio should be analyzed over several periods. Additionally, management may outsource production to reduce reliance on assets and improve its FAT ratio, while still struggling to maintain stable cash flows and other business fundamentals. As a quick example, the company’s A/R balance will grow from $20m in Year 0 to $30m by the end of Year 5. You don’t want to be judging yourself net working capital definition on a metric you set yourself—especially when it’s one that’s meant to help you improve your business. If a company’s industry has an asset turnover that is less than 0.5 like in most cases and the company’s ratio is 0.9; then the company is doing well, irrespective of its low asset turnover. To calculate the ratio in Year 1, we’ll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 total asset balances ($145m and $156m).