Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. balance sheet: definition example elements of a balance sheet Notice the balance in Income Summary matches the net income calculated on the Income Statement. We know that all revenue and expense accounts have been closed.

How do closing entries affect the Retained Earnings account?

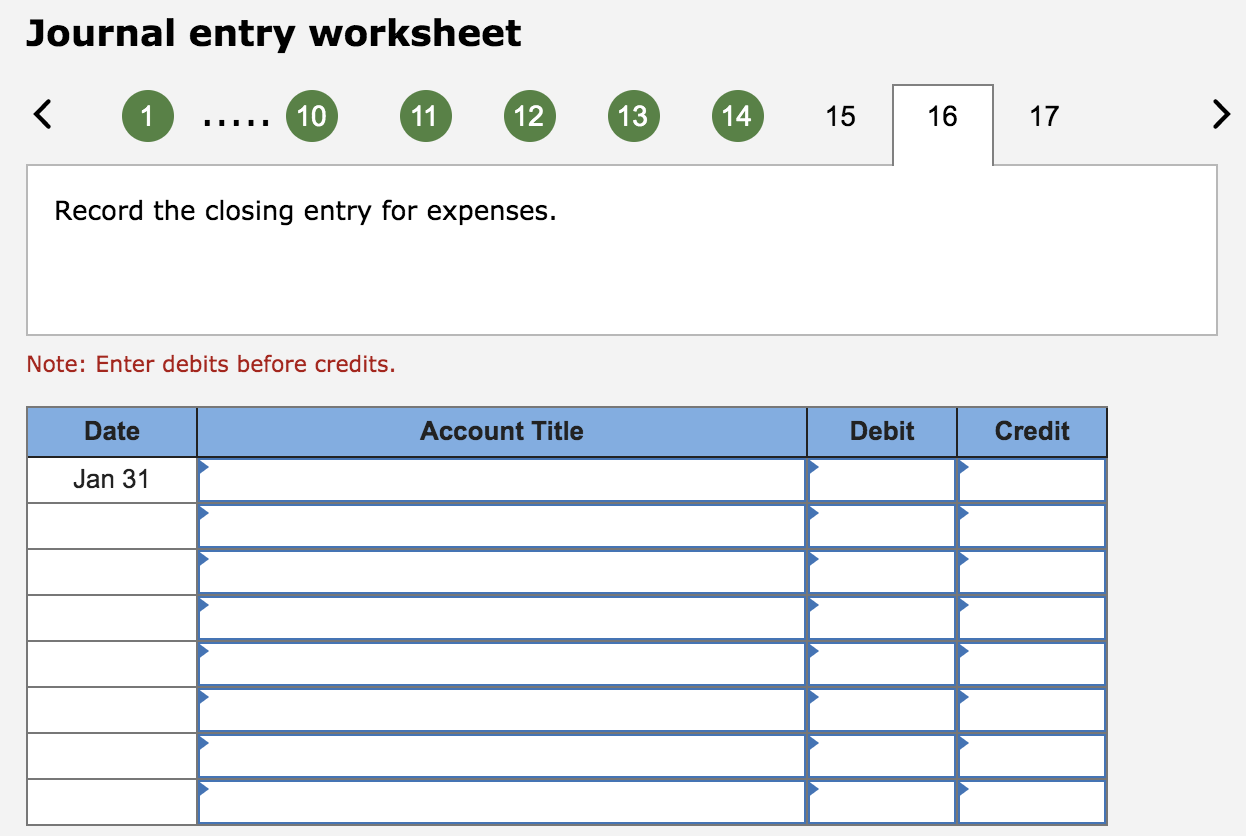

Temporary accounts will have a zero balance after closing entries are made. The process of using of the income summary account is shown in the diagram below. Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings.

What Accounts Are Affected by Closing Entries?

A temporary account is an income statement account, dividend account or drawings account. It is temporary because it lasts only for the accounting period. At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance.

Closing Entry in Accounting: Definition and Best Practices

- A closing entry is an accounting term that refers to journal entries made at the end of an accounting period to close temporary accounts.

- Another essential component of the Highradius suite is the Journal Entry Management module.

- Cash payments (“cash disbursements”) include any payments made by cash, check, or electronic fund transfer.

- These accounts are “temporary” because they start each accounting period with a zero balance and are used to accumulate data for that period only.

One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors. Permanent accounts track activities that extend beyond the current accounting period. They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data.

Also known as real or balance sheet accounts, these are general ledger entries that do not close at the end of an accounting period but are instead carried forward to subsequent periods . Real accounts, also known as permanent accounts, are quite different compared to their temporary equivalents. They persist from one accounting period to the next and maintain their balances over time unlike temporary accounts which are closed at the end of the period. These permanent files include assets, liabilities and equity sections making them very useful in showing the company’s financial position that lasts long. The income summary account serves as a temporary account used only during the closing process. It contains all the company’s revenues and expenses for the current accounting time period.

Double Entry Bookkeeping

Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry. In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner. In a partnership, a drawing account is maintained for each partner. All drawing accounts are closed to the respective capital accounts at the end of the accounting period. Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations).

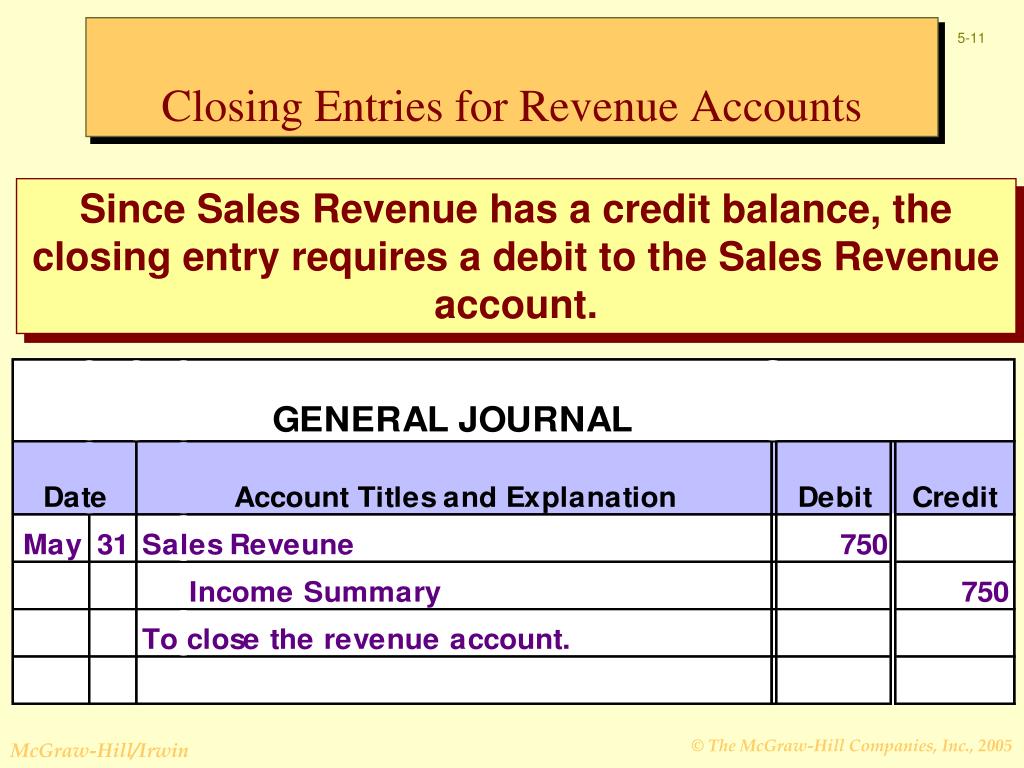

To close revenue accounts, you first transfer their balances to the income summary account. Start by debiting each revenue account for its total balance, effectively reducing the balance to zero. Then, credit the income summary account with the total revenue amount from all revenue accounts. Permanent accounts, also known as real accounts, do not require closing entries.

The same is true of your cash receipts journal, though this journal tracks the inflow, not the outflow, of funds. Automation transforms the process of closing entries in accounting, making it more efficient and accurate. By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors. Once we have obtained the opening trial balance, the next step is to identify errors if any, make adjusting entries, and generate an adjusted trial balance. And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period.