Therefore, the dividends payable account – a current liability line item on the balance sheet – is recorded as a credit on the date of approval by the board of directors. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. The debit to the dividends account is not an expense, it is not included in the income statement, and does not affect the net income of the business. The balance on the dividends account is transferred to the retained earnings, it is a distribution of retained earnings to the shareholders not an expense. The tax implications of dividend payments are a significant consideration for both companies and shareholders.

Balance Sheet

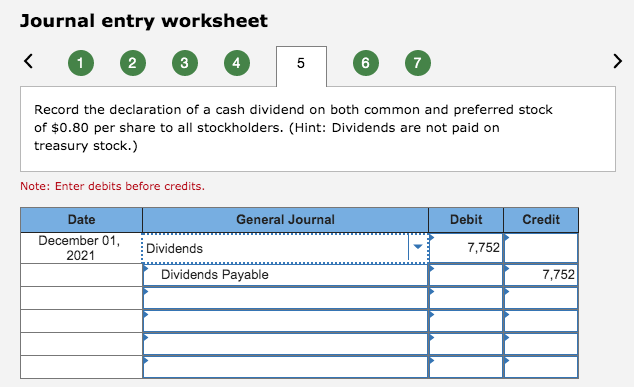

- Accountants must make a series of two journal entries to record the payout of these dividends each quarter.

- The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit).

- Many investors view a dividend payment as a sign of a company’s financial health and are more likely to purchase its stock.

- It is important to note that once declared, dividends become a legal obligation, and the company must ensure that it has sufficient liquidity to meet this commitment without jeopardizing its operational needs.

- The process of recording dividend payments is a two-step procedure that begins with the initial declaration and is followed by the actual distribution of dividends.

- If there is a deficit (negative balance) in retained earnings, any dividend would represent a return of invested capital.

Dividends are typically paid out of a company’s profits, and are therefore considered a way for the company to distribute its profits to shareholders. Dividends are often paid on a regular basis, such as quarterly or annually, but a company may also choose to pay special dividends in addition to its regular dividends. The company pays out dividends based on the number of stock shares it has outstanding and will announce its dividend as a certain amount per share, such as $1.25 per share. When paying dividends, the company and its shareholders must pay attention to three important dates. A dividend payment includes the amount of cash or other investments distributed to shareholders. That is, the current holders of stock receive additional shares of stock in proportion to their current holdings.

Comparing Small Stock Dividends, Large Stock Dividends, and Stock Splits

Under IFRS, dividends are recognized as a liability when they are appropriately authorized and no longer at the discretion of the entity. This typically occurs when the dividend is declared by the board of directors and approved by shareholders, if required. The timing of recognition is crucial for ensuring that financial statements accurately reflect the company’s obligations and financial position. Dividend Reinvestment Plans (DRIPs) offer shareholders an alternative to receiving cash dividends by allowing them to reinvest their dividends into additional shares of the company’s stock. For shareholders, DRIPs provide a convenient way to increase their investment without incurring brokerage fees, and they benefit from the compounding effect of reinvesting dividends.

Dividends Declared Journal Entry

A cash dividend is a payment made by a company, using its earnings, to its shareholders in the form of cash. Most investors purchase either common or preferred stock with the expectation of receiving cash dividends. turbotax freedom edition 2020 Since the cash dividends were distributed, the corporation must debit the dividends payable account by $50,000, with the corresponding entry consisting of the $50,000 credit to the cash account.

How to Record Dividends in a Journal Entry

When a company declares and pays dividends, it directly affects its retained earnings, reducing the amount of profit that is reinvested back into the business. The adjustment to retained earnings is a reduction by the total amount of the dividend declared. This reduction is recorded at the time of the dividend declaration, not when the dividend is paid. It is a reflection of the company’s decision to return value to shareholders, which decreases the retained earnings and, consequently, the total shareholders’ equity. This decision is strategic, as it balances the need to reward shareholders with the necessity to fund ongoing operations and future investments. The total stockholders’ equity on the company’s balance sheet before and after the split remain the same.

Over time, this can lead to significant growth in their holdings, especially if the company performs well. Retained earnings reflect a company’s accumulated net income after dividends have been paid out to shareholders. This account is a critical indicator of a company’s capacity to reinvest in its operations and its potential for future growth. When dividends are declared, whether cash or stock, an adjustment to retained earnings is necessary to represent the allocation of profits to shareholders rather than reinvestment back into the company. When a company decides to distribute dividends, the board of directors must first issue a formal declaration.

A percentage of profits can be paid as dividends, and a percentage can be reinvested back into the business. If a financial statement date intervenes between the declaration and distribution dates, the Stock Dividend Distributable account should be disclosed as part of Paid-In Capital. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Whether you issue dividends monthly or choose to only issue dividends following a strong fiscal period, you’ll need to record the transaction. Most of the time, businesses and business owners aren’t required to issue dividends. The record date is when the shareholder must be on the corporation’s records as owning stock. It is usually two to three weeks after the declaration date, but it comes before the payment date. When recording the declaration of a dividend, some firms debit an account entitled Dividends Declared instead of debiting Retained Earnings. Given the time involved in compiling the list of stockholders at any one date, the date of record is usually two to three weeks after the declaration date, but it comes before the actual payment date.

Both small and large stock dividends occur when a company distributes additional shares of stock to existing stockholders. At the date the board of directors declares dividends, the company can make journal entry by debiting dividends declared account and crediting dividends payable account. The first date is when the firm declares the dividend publicly, called the Date of Declaration, which triggers the first journal entry to move the dividend money into a dividends payable account. The second date is called the Date of Record, and all persons owning shares of stock at this date are entitled to receive a dividend.